The world that lies ahead – beyond sustainability misdefined.

Guest blog by: Jessie Henshaw is a Research Scientist at HDS Natural Systems Design Science. My expertise is in Recognizing Natural Patterns of organization and changing design in environmental, cultural and business systems, used for designing or guiding their transformations, sustainability and organizational learning.

That is when I noticed that what pressures people felt most

intensely were what they advocated for. The social activists had little feeling

for finance and finance leaders little for its growing impacts on the Earth and

humanity. Finance essentially defined them away, calling them “externalities”

of the profits system central to finance. To me, those two biases stood out as

displaying similar kinds of “missing information,” relying on our feelings about

what we were close to more than reporting and research.

That way of thinking started with noticing in the 1960s and 70s,

along with many others, that there was something wrong with “the system.” Innovation

seemed to be going from growing “creative destruction” to growing “destructive

creation.” As a baseline, rich and poor alike seem to have quite healthy

individual survival instincts. They easily sense when a growing intrusion in

their relationships needs a response. But why isn’t there a survival instinct

for society as a whole, or even some of its highly educated professions?

Recently I’ve been focusing on how the feelings and intuitions

that guide our survival in local environments seem mostly to come from nonverbal

cues. You see how well it works in developing close personal relationships,

friendships, and business connections. They all start with a nonverbal spark of

interest and then grow by small and then bigger steps of engagement. All the

good ones then respond well to the point when further steps would involve

higher levels of trust and connection. That signals a need for caution and changing

directions to either make things last, leave it casual, or walk away.

So, in what situations do we get the opposite, no direct

information about how our choices may change our world? We don’t get anything

but self-interest signals from money, even though every receipt, expenditure,

or addition to savings changes our relationships with the world. Each time they

reverberate through the global network of services, virtually never with

information about them at all. So money takes the whole world largely out of

context, cutting off our feelings.

Could that be why the fast-growing global pressures of endless

economic growth seem not to be noticed by economists, investors, governments,

and only an increasing number of others? Does money so isolate us from reality

that most just can’t feel what arguably threatens our whole species?

A kind of proof of it comes from how the 1987 Brundtland Report

(1) holistic definition of sustainability, caring for the present and the

future, change upon implementation. Soon after, institutions decided how to

first measure sustainability in terms of the resource inputs and outputs. The

reasoning was that businesses seemed to control and could accurately measure.

There was also the attraction that I/O (input/output) accounting came from

1940s economics. So it was a globally modeled system on the shelf that could be

easily adapted and was rigorously scientific.

However, it also appears there was no study of whether it would

work. So, perhaps the financial institutions knew it wouldn’t. After all,

business I/O decisions are actually predicated on someone else paying for them.

Investors at every level actively select, fund, and guide developments

according to their rule of maximizing the growth rate of their profits. That

rule of maximizing profits and making everything else “external” to the system

clearly mark it as a rule for fixed remote control steering of how the economy

will develop, an obvious fatal design flaw when you think about it. So, in any

case, excluding all responsibility for the impacts of money decisions might

have been the main interest of the financial institutions, perhaps led by the

OECD, in pushing the use of I/O data. It permanently held money harmless and excluded

the impacts of financial decisions from sustainability accounting.

Or… maybe the financial institutions were just blinded by their

total lack of information about how they were altering their environment. Money

decisions rarely ask for it. The “externalities” are all directly caused by the

economy and by the financial decisions managing it. People in finance use the

term to indicate those impacts are completely external to their way of thinking

about money.

I also watched as excluding “externalities” got a new twist in

the rules for reporting financial sustainability. The new rules would only

apply to sustaining growing investor profits, not the world from which they are

extracting profits, still called “sustainable investing.” However, it may often

be the opposite. I complained vigorously about how the discussions were going

to the UNEP FI and WRI groups developing the plans. All I got back was that their

financial advisors had veto power on any new rules. Perhaps that was also the

case before and after, and this is just a glimpse into the system.

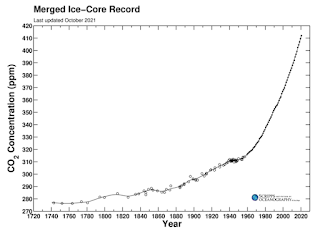

The proof seems to be in the curve in Fig 1. Maximizing economic

growth is a long-term practice. Atmospheric CO2, the main direct driving force

of climate change, is rising at its fastest ever exponential rate. Details of

how the two are linked are in Growth

Constant Fingerprints(2) and a survey in long tables of other linked

World Crises Growing with Growth (3). You may see some I’ve missed, too. As a

growth system pushes its limits, the pressures are widely distributed, so the

system tends to push all its internal and external limits at once.

The world that lies ahead is one in which we’ll see what we’re doing. The rich seem like everyone else, caught in the headlights essentially, unable to see outside the silo they built their lives around. The situation is dire, but we need to rise to it, our old ways of using power to give us more power have done us in. Look for the old roots of our ways of life that are still healthy.

References

1 The Brundtland Report - Report of the World Commission on Environment and Development: Our Common Future.

Wikipedia - https://en.wikipedia.org/wiki/Our_Common_Future

The Report - https://sustainabledevelopment.un.org/content/documents/5987our-common-future.pdf

2 A demonstration of scientific analysis and curve fitting of the analog curves of connected world systems, of course, misunderstood by the numerical modeling journals

JLH (2019) Growth Constant Fingerprints of Economically Driven Climate Change https://www.synapse9.com/drafts/2019_12-FingerprintsOfEconCC-MS.pdf

3 An experimental scientific taxonomy. are divided into eight categories and illustrate the scope of our exponentially diversifying and expanding global systemic threats. That is due, of course, to our interventions of all kinds upsetting nearly every kind of macro system on Earth, deeply disrupting our personal and societal ways of life.

JLH (2021) The Top 100 World Crises Growing with Growth

https://synapse9.com/_r3ref/100CrisesTable.pdf

4 The globally relied on world atmospheric CO2 data, combining ice core data from all over the world to 1958, then mountain top data from Antarctica and Hawaii after that. https://scrippsco2.ucsd.edu/data/atmospheric_co2/icecore_merged_products.html

Comments

Post a Comment