Upcoming Financial Crisis

By Felix Dodds, Adjunct Professor in Environmental Sciences and Engineering and Senior Fellow, Global Research Institute, University of North Carolina and

Eela Dubey Finance consultant

In October there was a very interesting briefing by UNCTAD of its report on Debt Vulnerabilities in Developing Countries: “A New Debt Trap? and its Trade and Development report.” It was the first of these reports that interested me most due to its coverage on the alarming trends in debt and extent of the debt crisis.

As the report points out, the global economy has been fueled by debt. The world's total gross debt to GDP ratio is at 223 percent, with advanced economies holding the largest share of debt stocks. A debt stock simply refers to the total value of the debt that a nation owes to all lenders. According to the Report, at the onset of the global financial crisis in 2008, global debt stocks surpassed their historical record level at $142 trillion. Now, with global debt at roughly $240 trillion, a baling $70 trillion higher than the last decade, it is unsurprising that policy makers are struggling to repair such an unbalanced economy.

What is even more scary, however, is the continued dependence of world economic growth on debt, which is having a deleterious effect on the global economy:

“Short-term speculative rather than long-term productive investments, is a constant source of instability as well as escalating income inequities. Governments in the core economies have been unwilling to tackle the systematic removal of toxic debt burdens, accumulated in the run-up to the global financial crisis of 2007/08, from non-bank private sector balance sheets in a comprehensive and orderly manner." (UNCTAD, A New Debt Trap? and its Trade and Development report)

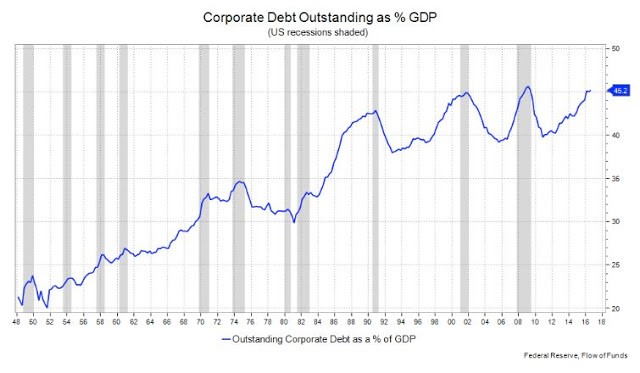

US Corporate Debt and Financial Crashes

Since the financial crisis in 2008, growth in corporate debt has exacerbated. The implications of this are particularly alarming when one considers the association between financial recessions and debt. Specifically, the graph above illustrates US corporate debt, with the shaded lines representing a crash and then the recession that follows. Though not a standalone factor for crashes, corporate debt has been a catalyst for phases of economic downturn since the early 1990s.

The rise in corporate debt is, in large part, due to the fact that many companies are shifting towards bond financing. In fact, in a study conducted by McKinsey, it was found that 19 percent of total global corporate debt is in the form of bonds. To add, a review of the fifty biggest corporate acquisitions over the last five years found that most were financed by debt (Bloomberg). By mid-2017, it was estimated that global nonfinancial corporate debt had doubled in the last decade and surged to $66 trillion.

Perhaps one of the most worrying features of the debt crises is the investment grade of companies borrowing loans and bonds. Tom Murphy from Columbia Threadneedle Investments says that "the rating (credit) agencies are giving companies too much wiggle room." In fact, according to Bloomberg, almost half the "corporate balance sheets contributed to a surge in debt rated in the bottom investment tier.” Here, we remember scents of the sub-prime housing failure, which was, in part, triggered by low grade mortgage backed securities.

Ten Years on from the Financial Crisis

With ten years having passed since the last financial crisis, there is looming worry that we are once again on the brink of a crisis and face extreme economic volatility. When asked to assess the risks of 2008 repeating, the former UK Prime Minister, Gordon Brown, commented that "we are in danger of sleepwalking into a future crisis.”

One of the reasons the US is increasing interest rates now as it did in the late 1990s is so that it has in its portofio of responses to a new financial crisis the ability to reduce interest rates. It will be one of the few things it could do to help address such a crisis.

We also need to be cognizant of the fact debt to GDP ratios are increasing substantially. In the United States, the ratio has increased to 108% from 62% in 2007. In Asia, the ratio has increased to 80% from a previous 47%. According to McKinsey, approximately two-thirds of the growth in corporate debt, in particular, has come from developing countries. China has been one of the biggest drivers of this growth: “from 2007 to 2017, Chinese companies added $15 trillion in debt. At 163 percent of GDP, China now has one of the highest corporate-debt ratios in the world.”

This is an apt reminder of two things. The first being that servicing this debt will be more expensive in a crash and recession. And, second, that developing countries, unlike the past, may be equally liable as developed nations.

Gordon Brown went on to reflect on how the international community might address a future crisis. He said:

“The cooperation that was seen in 2008 would not be possible in a post-2018 crisis both in terms of central banks and governments working together. We would have a blame-sharing exercise rather than solving the problem. In light of the trade war launched against Beijing by the US, Brown doubted that China would be as cooperative a second time. “Trump’s protectionism is the biggest barrier to building international cooperation."

An impending worry of many economists is the potential for a trade war. IMF head, Christine Lagarde, recently pointed out that higher US interest rates could have a big impact on developing countries governments and companies, urging that “this should serve as a wake-up call.” In the IMF annual economic outlook they also warned that:

"large challenges loom ahead for the global economy to prevent a second Great Depression."

SDGs and Climate Agreement

Another one of the major issues that the IMF and other institutions have been discussing is the increasing inequality in societies where the wealthy are hording funds rather than reinvesting them in the economy. This will naturally result in increased financial stress and quagmire.

One of the questions that was being asked around the UN General Assembly High Level Segment this year was “are we on the way to delivering the SDGs?” The answer is no. Let us look to why. The global sustainable development agreements are subject to the real world. By this, I mean what is going on and the ability of governments to focus on agendas that are beyond the next election. The 1972 UN Conference on Human Environment was impacted by the Yom Kippur War which caused the rise in oil prices. The 1992 Rio Earth Summit was affected by the first Iraqi War, the breakdown of the former Soviet Bloc and the increase in oil prices. The World Summit on Sustainable Development by 9/11, the second Iraqi war, and oil price increases. As we look around, we must ask ourselves what will impact the implementation of the SDGs as we move into the preparations for the Heads of State Review in 2019?

Clearly a new financial crisis will be a critical impact, as will be a further destabilization in the middle east. I write this as we are still trying to see what the cause of the disappearance of Jamal Khashoggi turns out to be. If as the Turkish Governments has suggested he was tortured and killed in the Saudi Consulate in Istanbul the impact of this as it would become a full blown diplomatic crisis which could destabilize the relation with the Saudi government and an increase in oil prices if sanctions are imposed.

On climate change we are in very dangerous waters. I live in North Carolina and we have had two major hurricanes/tropical Storms in a month. The recent IPCC report seems to be getting more coverage but is it going to cause real political action. Yet, I doubt it.

It looks like we are past ANY chance of getting to 1.5 degrees and at present policies we are looking at a 3.1 to 3.7% rise which is a disaster. The World Bank predicts on a 4 degree rise among the foreseen consequences are:

- the inundation of coastal cities

- increasing risks for food production potentially leading to higher malnutrition rates; many dry regions becoming dryer and wet regions wetter

- unprecedented heat waves in many regions, especially in the tropics

- substantially exacerbated water scarcity in many regions

- increased frequency of high-intensity tropical cyclones

- irreversible loss of biodiversity, including coral reef systems

We dont know what will causes the crisis, the mess that i called Brexit, the actions of Tariff Man, the Great Contraction of the economy in China which may become another Great Recession or the realization of how much toxic corporate debt is around and which banks are most vulnerable - but once it does this could be a bigger financial crisis than the 1920s. At the recent 32nd Economic Outlook Symposium hosted by the Federal Reserve Bank of Chicago. On the first day, a jounalist sat in a room with 150 economists. "When asked how many see a recession in 2019, all of two hands went up"

So Is it time for NGOs, other stakeholders and the UN who will be on the front time to be preparing the ground for this crisis? After all the impacts will, of course, be felt most by the poorest. The Sustainable Development Goals offer a way to help address the coming crisis but only if they become front and center of the next recovery package.

Comments

Post a Comment