The FINAL report of the Intergovernmental Committee of Experts on Sustainable Development Finance is out

I had been dreading this for the last few weeks particular

when a couple of members let me know what was and wasn’t in the report. So

today I got up went to my favourite local cafe order a couple of strong coffees

and read the report.

For those who do not read this blog often I would share with

you that I have had serious concerns about the way this committee’s work was

going from before the zero draft. I have blogged on it a number of times and

also put forward a set of 21 areas I would hope would be covered in the report.

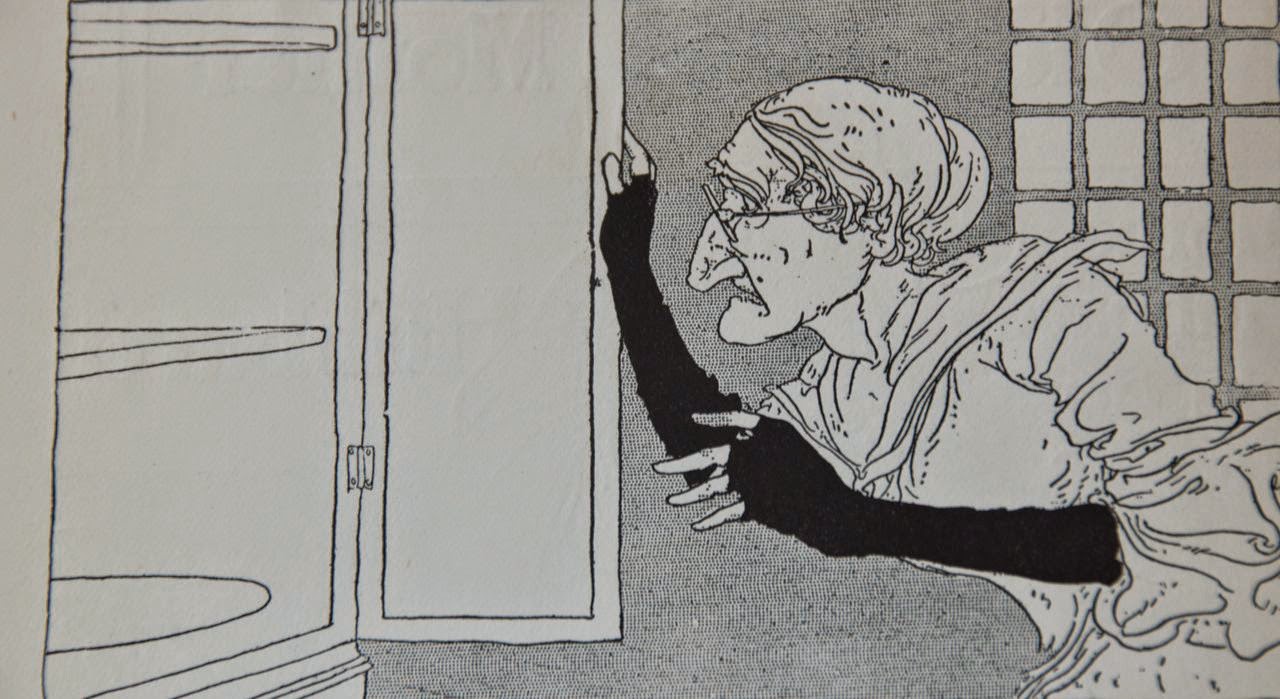

A warning to young readers this blog contains an unhappy and disappointed Felix.

Unhappy because of what the report could have been and disappointed because it means the work still will have to be done for next year. The cupboard of ideas is bare...

Stakeholder

engagement

All of this could have been so different. Stakeholders were

excluded from the meetings unlike the SDG OWG or other Intergovernmental

Committees on different issues of sustainable development over the last 20

years. This is infact the ONLY body on sustainable development to exclude

stakeholders. The governments who decided that should be ashamed of themselves. They should also be ashamed of themselves

when they in para 21 have the audacity to say:

“Building of the moralities and spirit that led to the Rio

Declaration and the Monterrey Consensus, we consulted widely with a range of

stakeholders, including civil society, the business sector, and other major

groups. This outreach was integral to our work and included multi-stakeholder

consultations, regional meetings, and calls for constitutions on our web site.

We are all grateful for all the inputs we received.” (UN, 2014)

I cannot think of ANY stakeholder organization that has

anything but contempt for the way

this committee has operated in secret. How many examples do we need to give on

when over the last 20 years these kind of committees would be open to

stakeholders to participate in eg Ad Hoc Open-ended Intergovernmental Group of

Experts on Energy and Sustainable Development, The Intergovernmental Panel of

Forests to name two!

Content

I take a deep breath here and wonder what they have actually

been doing over the last few months. The report is as had been expected heavily

Monterrey focused. Let me be clear I have no problems with the report having the

Monterrey material in it because debt, aid, trade are critical to dealing

sustainable development and poverty eradication. But and this the big But the

report that was asked for is as they say in para 1:

“255. We agree to establish an intergovernmental process

under the auspices of the General Assembly, with technical support from the

United Nations system and in open and broad consultation with relevant

international and regional financial institutions and other relevant

stakeholders. The process will assess financing needs, consider the

effectiveness, consistency and synergies of existing instruments and

frameworks, and evaluate additional initiatives, with a view to preparing a

report proposing options on an effective sustainable development financing

strategy to facilitate the mobilization of resources and their effective use in

achieving sustainable development objectives.”

The report does NOT seem to remember two other paras in the

Future We Want:

“253. We call on all countries to prioritize sustainable

development in the allocation of resources in accordance with national

priorities and needs, and we recognize the crucial importance of enhancing

financial support from all sources for sustainable development for all

countries, in particular developing countries. We recognize the importance of

international, regional and national financial mechanisms, including those

accessible to subnational and local authorities, to the implementation of

sustainable development programmes, and call for their strengthening and

implementation. New partnerships and innovative sources of financing can play a

role in complementing sources of financing for sustainable development. We

encourage their further exploration and use, alongside the traditional means of

implementation.

254. We recognize the need for significant mobilization of

resources from a variety of sources and the effective use of financing, in

order to give strong support to developing countries in their efforts to

promote sustainable development, including through actions undertaken in

accordance with the outcome of the United Nations Conference on Sustainable

Development and for achieving sustainable development goals.”

Which paras you take as your starting point and which you

don’t do then lead to a report taking a particular direction.

Content against my 21

suggestions

My 21 issues from the report

|

How does the report do

|

What should it have said

|

1.Differential approach to countries in

different levels of development and what financial packages might be most

useful for those countries (could be based on the UNDP Human Development

Index);

|

Not done:

|

This suggestion I have to admit does

have some problems associated with it as some of the levels of development

that are in the HDI do not have formal UN definitions. But I am sure this

could have been finessed. What this approach would have done is help focus

the financial considerations to the countries requirements e.g. an LLDC needs

different packages than an LDC or a medium developed country.

|

2.The mechanisms to help countries move

from one level of development to another as funding portfolios change;

|

Not done:

|

What is needed is a clear set of

guidance for how countries stabilize their new status as they move from one

level to the other. though there is some recognition of the continued role

that 0DA play to LDCs

|

3.What regulations need to be put into

place to ensure the FDI does not impact negatively on sustainable development;

|

(125) FDI remains the most stable and

long-term source of private foreign investment to developing countries, and

has a critical role to play in financing sustainable development. However, policymakers need to monitor the quality of

FDI to maximize its impact on sustainable development. Governments should, as

appropriate, adopt policies that encourage linkages between

multinational enterprises (MNEs) and

local production activities, support technology transfer, provide local workers with opportunities for further

education, and strengthen the capacity of local industry to effectively

absorb and apply new technology. Corporations that embrace human rights

principles, labour, environment and anti-corruption values, as in the Global

Compact or other international social and environmental standards, may serve

as a model for other enterprises. At the same time, host governments should

require all companies, including foreign investors, to meet the core labor

standards of the International Labor Organization, and encourage EESG

reporting, making sustainable development an essential element in company

strategies.

|

It should have a suggestion of

regulation to address this.

|

4.A recognition that FDI only helps

some middle income countries;

|

The report does expose that perhaps I

was wrong to be so stark - there has been growth in FDI outside middle income

countries Africa saw a 6.8% rise in FDI and “FDI flows to developing

economies reached a new high of US$759 billion, accounting for 52% of global

FDI inflows in 2013.

|

|

5.A section on what local and regional

governments might be able to achieve and what financial portfolio might be

available to them;

|

No section on this only gets a cursory

mention of the role that subnational can play:

(75) At the same time, 13 countries

have initiated some form of national or sub-national carbon taxes.

Some mention of local level financing

(98) Local bond markets can thus play

an important role in financing long Term sustainable development and The

effective cooperation for sustainable development, including its financing

aspects, requires a global partnership with the meaningful involvement and

active participation of developing and developed countries, multilateral and

bilateral development and financial institutions, parliaments, local

authorities, private sector entities, philanthropic foundations, civil

society organizations and other stakeholders

|

Huge missed opportunity to identify the

role that local and sub-national governments could play

|

6.A deep dive into what role Capital

Markets could do to help sustainable development;

|

Not a very deep dive but a start:

(85) Governments can use National

Development Banks to strengthen capital markets and leverage investments in

sustainable development. For example, some NDBs finance (part of) their

activities through the issuance of bonds that allocate funds raised to a

particular use, such as green infrastructure with the proceeds allocated to

specific classes of investment (e.g. green bonds).

(89) An enabling environment is

essential for reducing risks and encouraging private investment. In addition,

governments can work to develop local capital markets and financial systems

for long-term investment, within a sound regulatory framework. (98) To

successfully develop local capital markets, policymakers need to build

institutions and infrastructure, including supervision, clearing and

settlement systems, effective credit bureaus, measures to safeguard

consumers, and other appropriate regulation

|

It lacks depth in what needs to be done

|

7.Action on Sovereign Wealth Funds was

originally suggested in the UN Sustainable Development Panel Report – to

advance this we should have text suggested on how to amend the Santiago

Principles (Generally Accepted Principles and Practices (GAPP));

|

Sovereign wealth funds handle public

money, but are managed like private investors. The report does not explain

what can be done to address SWFs.

|

Santiago Principles - Generally Accepted Principles and Practices

(GAPP)

a.Amend GAPP 14. Principle Dealing with

third parties for the purpose of the SWF's operational management should be

based on economic and financial and sustainable development grounds, and

follow clear rules and procedures.

b.GAPP 18. Principle The SWF's

investment policy should be clear and consistent with its defined objectives,

risk tolerance, and investment strategy, as set by the owner or the governing

body(ies), and be based on sound portfolio management principles.

i.GAPP 18.1 Subprinciple The investment

policy should guide the SWF's financial and sustainable development risk

exposures and the possible use of leverage.

c.GAPP 19. Principle The SWF's

investment decisions should aim to maximize risk-adjusted financial returns

in a manner consistent with its investment and sustainable development

policy, and based on economic and financial grounds.

d.GAPP 19.1 Subprinciple If investment

decisions are subject to other than

sustainable development, economic and financial considerations, these

should be clearly set out in the investment policy and be publicly disclosed.

e.And add a new sub principle GAPP 22.3

Subprinciple: Independent opinions for the SWF commissioned from rating

agencies on the credit risk of debtors (private or public) shall be based on

financial and non-financial criteria including sustainable development.

Credit rating agencies shall be required to demonstrate to the SWF their

competency to undertake such ratings (evaluation framework, qualified

analysts). Monaghan (2012) Rating Sovereign Raters: Credit Rating Agencies –

Political Scapegoats or Misguided Messengers? (Manchester: Infrangilis).

|

8.The UN Sustainable Development Panel Report

and the High Level Panel Report on Post 2015 Development Agenda to introduce

in Stock Exchanges the requirement for all companies to report or explain on

their Sustainable Development Report. We should see text and a date for this

to happen – 2020?

|

Recognizes (48) (105) that corporate

reporting is important.

(125) Corporations that embrace human

rights principles, labour, environment and anti-corruption values, as in the

Global Compact or other international social and environmental standards, may

serve as a model for other enterprises. At the same time, host governments

should require all companies, including foreign investors, to meet the core

labor standards of the International Labor Organization, and encourage EESG

reporting, making sustainable development an essential element in company

strategies.

|

Should set 2020 for compulsory reporting

of all companies listed on any stock exchange

|

9.How to expand the role of

micro-finance, micro-credit and micro-insurance to support the base of the

pyramid;

|

(91) Many governments have thus

provided and/or welcomed providers of financial services for the poor,

including through microfinance institutions, cooperative banks, postal banks

and savings banks, as well as commercial banks. (94) s. With the growth of

microfinance institutions, both managers and regulators should be concerned

about the need to balance expanding access to financial services with

managing risks, including social risks of household indebtedness.

(95) Frequently, SMEs’ financial needs are

too large for the traditional moneylenders and microcredit agencies, while

large banks tend to bypass this market, due to administrative intensity, the

lack of information and the uncertainty of credit risk. By providing credit

information, credit registries/bureaus, and collateral, and insolvency

regimes could help extend SME access to credit.

(102) A robust regulatory framework

should consider all areas of financial intermediation, including shadow

banking ranging from microfinance to complex derivative instruments.

Enhancing stability and reducing risks while promoting access to credit

presents a complex challenge for policymakers, since there can be trade-offs

between the two. Policymakers should design the regulatory and policy

framework to strike a balance between these goals. For example, the European

Union included special provisions (e.g. Capital Requirement Directive IV) in

its implementation of Basel III to reduce the capital cost of lending to

SMEs. There are also calls for financial sector regulatory systems to be

widened from focusing on financial stability to include sustainability

criteria.

|

Good language on this.

|

10.How cooperatives or mutual funds can

be utilized for sustainable development;

|

Very little attempts to engage this

community (91) Many governments have thus provided and/or welcomed providers

of financial services for the poor, including through microfinance

institutions, cooperative banks, postal banks and savings banks, as well as

commercial banks. (96) Cooperative banks, post banks and savings banks are

also well suited to offer financial services to SMEs, including developing

and offering more diversified loan products

|

Could have suggested regulatory changes

to open these funds more.

|

11.What role the IFIs should play in

implementing sustainable development;

|

(116) International Monetary Fund

(IMF), the World Bank and the other international and regional financial

institutions (IFIs), are key sources of medium and long-term finance for the

countries that draw upon them. Important financing modalities include public

loans to governments, equity and debt finance for the private sector and a

range of blended financing instruments, including risk-mitigating. (119) the Committee recommends that the level of

concessionality of international public finance should take into account both

countries’ level of development (including their level of income,

institutional capacity, and vulnerability) and the type of investment. Concessionality

should be highest for basic social needs, including grant financing

appropriate for least developed countries. Concessional financing is also

critical for financing many global public goods for sustainable development.

For some investments in national development, loan financing instruments

might be more appropriate, particularly when the investment can potentially

generate an economic return. instruments such as credit and political risk

guarantees, currency swaps and arrangements combining public and capital market

funds (e.g. on traditional infrastructure projects). When employed according

to country and sector needs, and building on their specific advantages, they

can help mitigate risk and mobilize more upfront financing than would be

available from budget resources alone, as discussed in Section VI.E on

blended finance. It is also important to ensure that LDCs are not refrained

from accessing, solely on the basis of their income, less concessional funds

from IFIs and DFIs. Financially viable projects should instead be considered

on a case-by-case basis,

|

Could have provided guidance on how to

do this

|

12.IFIs should be audited against the

SDGs to ensure their actions do not go against what will be agreed in 2015 –

a do no damage clause;

|

Nothing on this

|

IFIs set up an annual audit of their

projects and ensure they are doing at least no harm

|

13.What reform of trade rules might

help deliver the SDGs and to ensure that trade supports sustainable resource

use and not the opposite;

|

(72) Similarly, countries should

correct and prevent trade restrictions and distortions in world agricultural

markets, including by the parallel elimination of all forms of agricultural

export subsidies and all export measures with equivalent effect, in

accordance with the mandate of the Doha Development Round. (75) deals with ‘cape

and trade’

(153) In addition, the increased

prevalence of global value chains has tightened the link between trade and

foreign direct investment. To achieve

a better balance between investor rights and the sovereign capacity for

recipient states to regulate within areas of public interest, the

international community could consider, as appropriate, a further elaboration

of standards for investment in areas that directly impact domestic

sustainable development outcomes, and ensure that investments do not

undermine international human rights standards. (154) In general, the

proliferation of bilateral investment treaties and other trade agreements

covering investment issues renders the mainstreaming of a sustainable development

perspective in investment regimes more difficult.

|

Some attempt to link trade and human

rights but little to layout a framework that would be robust to supporting sustainable

development.

|

14.I expect to see some thoughts on the

role that local, national and international green bonds and the role they

might play;

|

Only one mention of Green Bonds:

(85) Governments can use NDBs to

strengthen capital markets and leverage investments in sustainable development.

For example, some NDBs finance (part of) their activities through the

issuance of bonds that allocate funds raised to a particular use, such as

green infrastructure with the proceeds allocated to specific classes of

investment (e.g. green bonds).

|

Should have identified what a role

Green Bonds could play could have utilized the work on Climate Bonds to

develop this. Or the work that Maurice Strong did for Rio+20 on Earth Bonds.

|

15.What can green banks do to promote

sustainable development we now have examples in places like the UK and

Australia;

|

No mention of the role these might play

|

A set of recommendations based on the

experience of Australia and the UK

|

16.The report needs to address

intergenerational equity – environmental resources and ecosystems must be

carefully managed to ensure the value of assets are there for future

generations;

|

(68) Governments can also design

policies to ensure that a share of resource earnings are saved and invested

for the benefit of future generations, as in sovereign wealth funds (SWFs).

|

This should have been a core element of

the whole report and integrated through all the recommendations

|

17.There should be suggestions on

international liability to actions taken within national boundaries that have

environmental impacts beyond national jurisdictions;

|

Nothing on this

|

Could have suggested the setting up of

a Court of Arbitration and Conciliation to deal with this.

|

18.Reform of credit rating agencies

requiring them to build in sustainability criteria;

|

Nothing on this

|

Reform of the rules for Credit Rating

Agencies to include sustainability criteria OR create under the World Bank an

International Credit Rating Agency and take it out of private hands.

|

19.Taking away subsidies from fossil

fuels and agriculture;

|

Some suggestions here

(41) In all subsidy decisions,

however, any adverse impacts on the poor and the environment need to be

addressed, either through appropriate compensating policies or through better

targeting.

(71)

Countries should review the efficacy of all subsidies as a matter of sound

fiscal management. Countries should consider rationalizing inefficient fossil

fuel subsidies that encourage wasteful consumption by removing market

distortions, in accordance with national circumstances, including by

restructuring taxation and phasing out those harmful subsidies, where they

exist, to reflect their environmental impacts. Such actions should fully take

into account the specific needs and conditions of developing countries and

minimize possible adverse impacts on their development in a manner that

protects the poor and affected communities

(72) Similarly, countries should

correct and prevent trade restrictions and distortions in world agricultural

markets, including by the parallel elimination of all forms of agricultural

export subsidies and all export measures with equivalent effect, in

accordance with the mandate of the Doha Development Round.

|

Could have included clear recommendations

on how --- these are general statements

|

20.Addressing the issue of resilience

funding for disaster relief preparation;

|

Good recommendation here

(80) There is also an urgent need for

governments to invest adequately in disaster risk mitigation and in systems

that build resilience against shocks, as well as in environmental

preservation, especially in areas where local populations depend on natural

resources.

|

|

21.A plan for introducing the Tobin

Tax.

|

No recommendation

(51) The Leading Group on Innovative

Financing for Development has pioneered on a voluntary basis a number of

fund-raising mechanisms to raise additional resources, including the

international solidarity levy on air tickets,37 the funds from which are

contributed to UNITAID to help purchase drugs for developing countries.

Eleven countries using the euro currency are currently envisioning a

financial transaction tax from 2016, albeit without earmarking funds for

development or financing of global public goods as of yet. Some countries

(e.g. France) have, at the national level, put in place a financial

transaction tax, with part of the proceeds used to finance ODA programmes.

|

Should have recommended the

introduction of a Financial transaction tax by 2020.

|

This comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDelete