Greenwashing is a Communications Problem

Greenwashing and How to Avoid It - TUGI (theurbangardeninitiative.org)

Guest blog by John Treadgold who is Sustainable Investment Thought Leadership Expert This was originally published here.

It was my first business trip since my son was born. I had to dust off my luggage and my suit jacket, but the early flight was a breeze, I’m now accustomed to being up at 5am.

I was heading to Melbourne for the RIAA Conference, I’d been invited to host a panel on impact investing (I’ll write about that next week), but I was able to catch some other sessions. After two days, I was left with two key takeaways:

1.

Every investment manager

and super fund is hurriedly reviewing their external reporting. The regulators have moved from talk, to action, on the topic of enforcing accuracy of

sustainability claims. While everyone’s double-checking the language used, some

have even pulled major portions of their reports, in what is being called green-hushing.

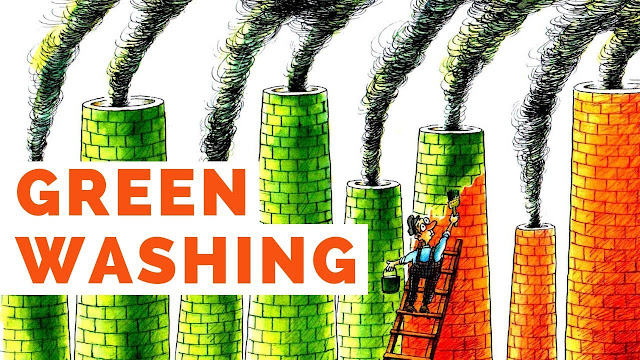

2. Greenwashing is a communications problem; it’s when a firm’s public statements don’t match the fine-print on the investment policy. A simple solution is to embed subject-matter expertise into your comms and marketing team.

ESG: Woke and Broke

I did get to the airport early, but my flight was held up both on the

tarmac, and on approach to Melbourne, which meant I missed the start of the

first session, and by all accounts, it was spicy.

It was titled, ‘ESG Woke and Broke’, referring to the painful

politicisation of ESG investing by conservative pundits in the US. The original

plan was to invite the UK journalist who wrote a much-criticized series

of articles for The Economist about the problems with ESG. In the end he pulled

out.

The panel saw Fiona Reynolds (ex head of PRI, and now an independent

director) in a robust conversation with Professor Timothy Lynch from University

of Melbourne, and Jens Peers from Mirova. Estelle Parker was moderating.

By all accounts Professor Lynch offered a dose of scepticism to our

devotion towards ESG and the sustainability movement. Fiona Reynolds did well

to push-back against some of his simplistic claims, and Jens Peers offered

depth into the core difference between long-term and short-term perspectives.

In the short-term, climate-denialism may be profitable, but in the long-term, there is no justification – so-called ‘non-financial factors’ become financially material very quickly.

The Regulator Gets Serious About Greenwashing

Later in the day Karen Chester, Deputy Chair at ASIC, took the stage, aka

‘the regulator’, and everyone sat quietly and listened. She spoke almost

exclusively about greenwashing with explanations of the warnings ASIC had

offered, the guidelines that

had been published, and she announced ASIC would be publishing a list of

some 35 enforcement actions in parallel with her presentation.

It would serve to clarify and enforce previous warnings that ASIC was

serious about enforcing its mandate.

“Greenwashing is a corrosive agent to market efficiency.” she explained.

“We have developed three core antidotes to greenwashing;

·

Transparency through

disclosure

·

Policy installed bright

lines

·

Regulators doing their

jobs”

“But what about unintended consequences like greenhushing?” Simon

O’Conner asked.

“We want our action to be an accelerator, not a handbrake.” she said.

Greenwashing Is a Communications Problem

The topic of greenwashing would go on to dominate the conference. But

what struck me, was that it was being dealt with from purely a communications

perspective.

As the ASIC definition says:

‘Greenwashing is the practice of misrepresenting the extent to which a financial product or investment strategy is environmentally friendly, sustainable or ethical and is an enforcement priority for ASIC.’

In reading through the 35 cases in the ASIC update, the key issue was the way a company communicated the nature of its product or investment. And the remedy was to remove or update the statement that was deemed to be a ‘misrepresentation’.

But, there was no expectation that the company would instead commit to the claim that had been made. There’s no expectation they upgrade their investment approach to actually target net zero by 2050, or that their exclusions would thoroughly avoid investing in those selling tobacco products.

The issue was in exaggerating claims, it wasn’t a lack of action on

climate change.

Of course ASIC’s action IS progress, and by raising the bar on sustainability claims, investors will have greater certainty about the integrity and impact of a fund.

But even those leading the way on sustainable investing are at risk. Future Super was slapped with a fine when it was found to have overstepped the mark with a Facebook ad that said it ‘moved $400M out of fossil fuels’. In reality, this was its total FUM, it’s a stretch to say ALL of those fund inflows had been invested in fossil fuels.

It’s since been explained that the firm removed the Facebook post when it realised the oversight, and that it was self-reported to ASIC.

‘Sophisticated Communications’ Is More Important Than Ever

The lesson here is that how you communicate your sustainable investment approach is as important as the investment policy behind it. And problems like these can be avoided by embedding subject-matter expertise in your marketing team.

I call it ‘Sophisticated Communications’. It involves employing a specialist communicator to act as a translator between the investment, ESG and marketing teams.

It could be an ESG analyst that has high-level communication skills, or a comms person who has developed a deep understanding of sustainable investing. Their value is that they speak the language of the investment team, while also being fluent in marketing and the needs of modern multi-platform content and communications.

Who’s in charge of communicating your sustainable investment strategy?

Comments

Post a Comment